Introduction

Kya aap bhi ₹2 crore ki wealth banane ka sapna dekhte hain, lekin salary kam hone ki wajah se unsure feel karte hain? Agar haan, toh ye guide aapke liye hai!

Aap sirf ₹10 lakh invest karke bhi ₹2 crore ya usse zyada wealth create kar sakte hain—bas sahi saving habits aur smart investment strategies ko follow karna hoga.

Is article mein aapko 7 simple aur powerful steps milenge jo aapki salary ko wealth mein badalne mein madad karenge.

1. 7-Day Rule Follow Karein – Bina Soche Kharch Karna Band Karein

- Koi bhi cheez lene se pehle 7 din wait karein.

- Agar 1 hafte baad bhi zaroorat mehsoos ho, tabhi us cheez ko kharidein.

- Is rule se aap impulse buying se bachenge aur bina wajah kharche kam ho jayenge.

💡 Focus Keywords: Spending habits control, smart savings strategy

2. Savings Aur Expenses Ke Liye Alag Bank Accounts Rakhein

- Ek account salary aur savings ke liye rakhein.

- Doosra account sirf kharche ke liye use karein.

- Payday par turant 60% salary kharche wale account mein transfer karein.

- Is method se aap spending control kar sakte hain aur saving ka habit bana sakte hain.

💡 Focus Keywords: Salary management tips, effective savings strategy

3. Har Ek Rupee Ka Hisaab Rakhein

- Daily expenses track karein aur dekhein kahan fizool kharcha ho raha hai.

- Expense tracking apps ya diary ka use karein.

- Jab aap kharche ko analyze karenge, toh saving badhane ka scope milega.

💡 Focus Keywords: Expense tracking tips, money management

4. Cash Payments Karein, UPI Aur Cards Avoid Karein

- Jab bhi discretionary spending (luxury ya extra expenses) karein, cash use karein.

- UPI aur credit cards se spending easy hoti hai, jo extra kharche ko badhata hai.

- Jab aap physical cash dete hain, toh spending ka psychological impact hota hai, aur aap soch samajh kar paisa kharch karte hain.

💡 Focus Keywords: How to reduce unnecessary spending, cash vs card payments

5. Step-Up SIP Mein Invest Karein – Wealth Badhane Ka Smart Tareeka

- Step-Up SIP ek aisi strategy hai jisme har saal SIP amount badhate hain.

- Kaise kaam karta hai?

- ₹5,000 per month SIP se shuruaat karein.

- Har saal 10% SIP increase karein (salary increment ke saath).

- 20 saal baad aapka portfolio ₹2 crore tak pahunch sakta hai!

- Sirf ₹25 lakh invest karne par bhi compounding ke wajah se ₹2 crore ka wealth ban sakta hai.

💡 Focus Keywords: Best SIP strategy, how to become a crorepati with SIP

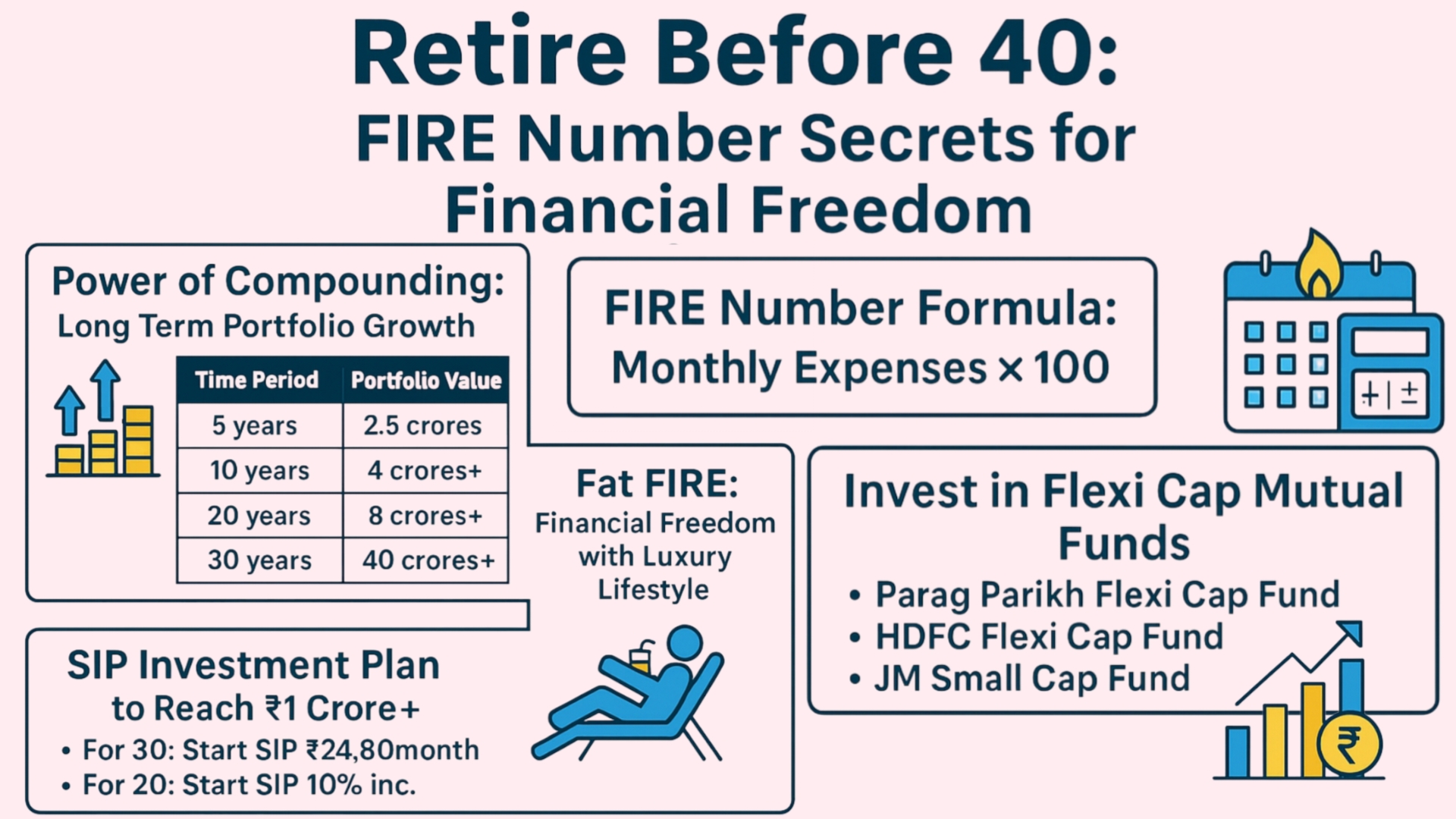

6. Compounding Ka Power Samjhein – 40 Ke Baad ₹40 Crore Kaise Ho Sakte Hain?

- Compounding ek magic formula hai jo aapko long-term wealth banane mein madad karta hai.

- Agar aap SIP continue rakhein, toh 50 saal ki age tak ₹40 crore ka portfolio ho sakta hai!

- Bas discipline aur long-term investing follow karein.

💡 Focus Keywords: Power of compounding, long-term wealth creation

7. Market Timing Na Karein – Consistent SIP Se Profit Banayein

- Market ko time karna mushkil hai, isliye SIP best strategy hai.

- Regular investing se market ke fluctuations ka impact kam hota hai.

- SIP ka formula: Invest and Forget!

💡 Focus Keywords: SIP vs market timing, how to invest smartly

Final Thoughts: Kam Salary Se ₹2 Crore Kaise Banayein?

Agar aap disciplined hain aur in steps ko follow karte hain, toh aap bhi ₹2 crore ka wealth before 40 create kar sakte hain.

Wealth banane ke 4 golden rules:

✅ Discipline se saving karein

✅ Smart spending habits adopt karein

✅ SIP aur compounding ka fayda uthayein

✅ Long-term perspective rakhein

🚀 Aaj se hi apni financial journey start karein aur ek crorepati banne ki taraf badhein!

📢 Aapko ye article kaisa laga?

Agar aapko ye tips useful lage, toh share karein aur aise hi aur financial growth hacks ke liye follow karein! 🚀💰